The US rental market has seen significant shifts over the past few years. With changing economic conditions and societal trends, the dynamics of renting vs. owning have evolved.

Here’s an updated look at the state of renting in the US in 2023.

Contents

- US Rental Households

- States With the Most Renters

- Renter Demographics

- Renter Facts & Figures

- Renting vs. Owning

2023 US Rental Households

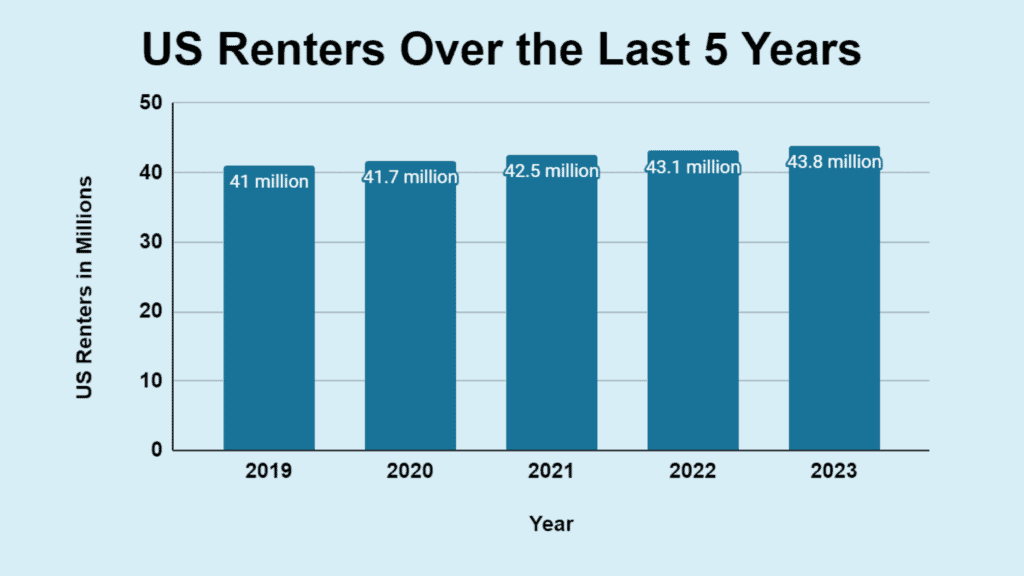

- 43.8 million US households were renters in 2023.

- The overall percentage of renters in the US in 2023 was approximately 34%.

- Renting households saw a steady increase over the past five years.

| 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| 41 million | 41.7 million | 42.5 million | 43.1 million | 43.8 million |

In 2023, approximately 43.8 million US households lived in rented homes. This represents around 34% of all US households.

Notably, there has been a consistent rise in renting households over the past five years.

Sources: Rent.com, Census.gov

States With the Most Renters

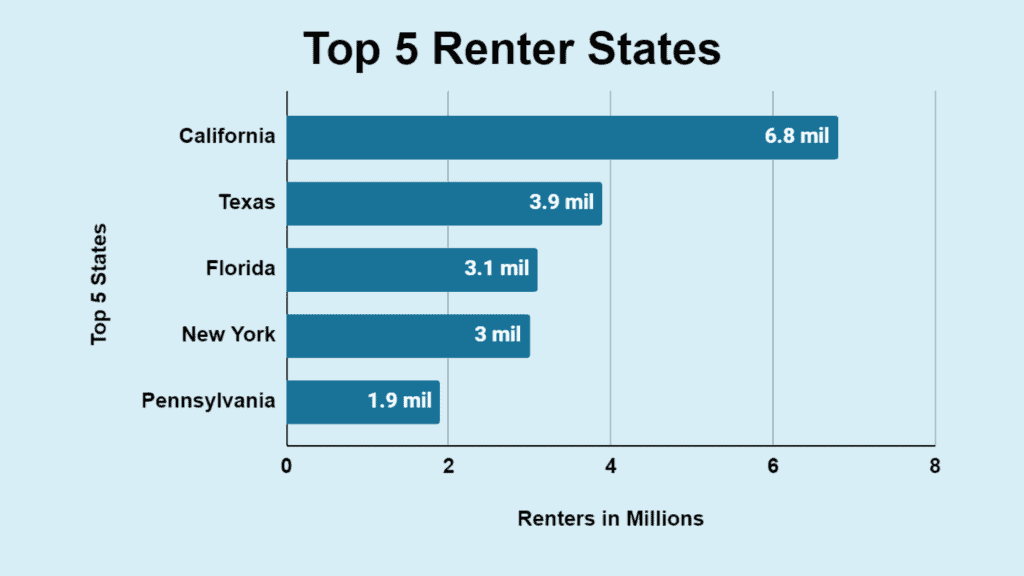

The landscape of US renters was predominantly shaped by five states in 2023, with California leading the pack. Texas and Florida followed closely behind. New York and Pennsylvania rounded out the top five.

| Top 5 States | Number of Renters |

|---|---|

| California | 6.8 million |

| Texas | 3.9 million |

| Florida | 3.1 million |

| New York | 3 million |

| Pennsylvania | 1.9 million |

In 2023, the profile of US renters was significantly influenced by five dominant states. California stood at the forefront with 6.8 million renters.

Texas, with 3.9 million renters, and Florida, with 3.1 million, trailed closely. New York, accommodating 3 million renters, and Pennsylvania, housing 1.9 million, completed the top five states with the highest number of renting households.

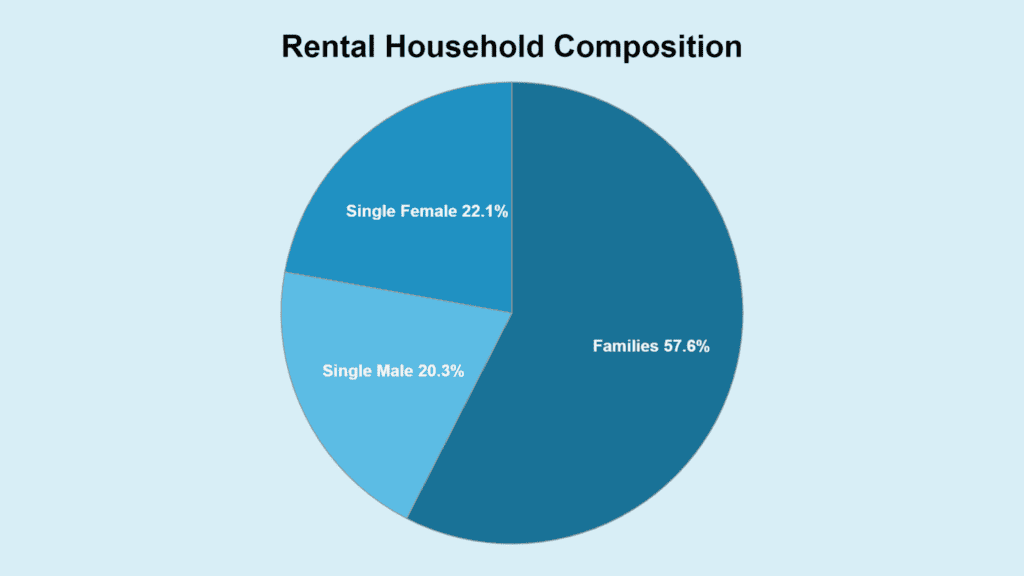

Renter Demographics

In 2023, the demographic landscape of U.S. renters revealed that a significant 65% are under age 35.

With a median annual gross income of approximately $37,300, renters were diverse in their household compositions.

Household Composition: Families – 25.2 million, Single Male – 8.9 million, Single Female – 9.7 million.

| Household Composition | Number of Renters | Percentage |

|---|---|---|

| Families | 25.2 million | 57.6% |

| Single Female | 9.7 million | 22.1% |

| Single Male | 8.9 million | 20.3% |

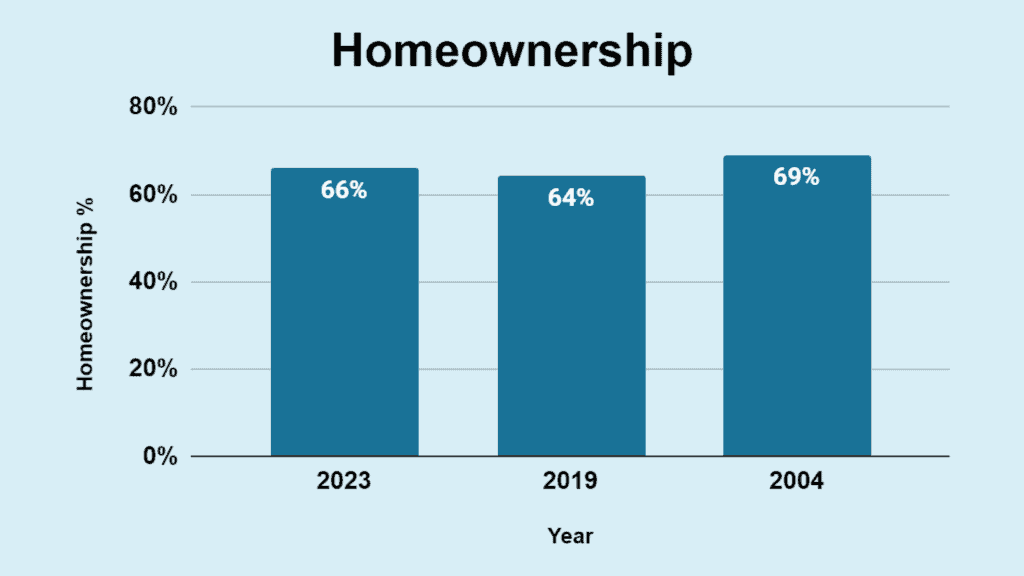

Over the past two decades, the US has witnessed a shift in housing preferences, with homeownership rates dipping 6.96% from 2004 to 2019.

However, by the first quarter of 2023, this rate rebounded slightly. The allure of renting remains strong for many.

Renter Facts & Figures

The US rental landscape has changed immensely over the last ten years. In 2023, nearly 43% of renters allocated over a third of their income toward rent.

This robust demand, particularly in suburban areas, is further influenced by the rise of telecommuting, reshaping rental priorities.

- The US saw an increase of 10 million renters in the last decade, the largest 10-year gain on record.

- The average rent was $2,052/month for an apartment in 2023. Note that rent prices vary significantly based on the apartment’s location, size, and quality.

- The rental vacancy rate for the second quarter of 2023 was 6.3%.

Renting vs. Owning

- The homeownership rate in the U.S. for the first quarter of 2023 was 66%.

- Homeownership rates declined from 69% in 2004 to 64% in 2019.

- The top reasons for renting include flexibility to move, lack of maintenance responsibilities, and financial constraints.

| Year | Homeownership % |

|---|---|

| 2023 | 66% |

| 2019 | 64% |

| 2004 | 69% |

In the first quarter of 2023, the U.S. homeownership rate stood at 66%. This reflected a fluctuation from previous years, as the rate had decreased from 69% in 2004 to 64% in 2019.

Many individuals rent due to the flexibility it offers in relocating, the absence of maintenance obligations, and financial limitations.

Sources: Eye on Housing, RubyHome, iPropertyManagement

Conclusion

In recent years, the U.S. housing market has experienced notable shifts, with renting becoming an increasingly popular choice for many households.

Demographically, younger individuals, particularly those under 35, dominate the rental scene, while many households prioritize renting for its flexibility and financial considerations. Although homeownership saw a slight resurgence in 2023, the allure of renting remains strong.

As the decade progresses, understanding these trends will be crucial for policymakers, real estate professionals, and renters alike, ensuring that the housing market continues to meet the diverse needs of the US population.

Remember, while these statistics provide a broad overview, the rental market can vary significantly based on various factors.

Additional Research

Understanding the financial implications of household choices is particularly relevant. The shift toward more cost-effective and eco-friendly living is an important consideration.

Additionally, the growing trend of pet ownership adds another dimension to this conversation, highlighting the intersection between our living situations, financial choices, and how we care for our furry friends.